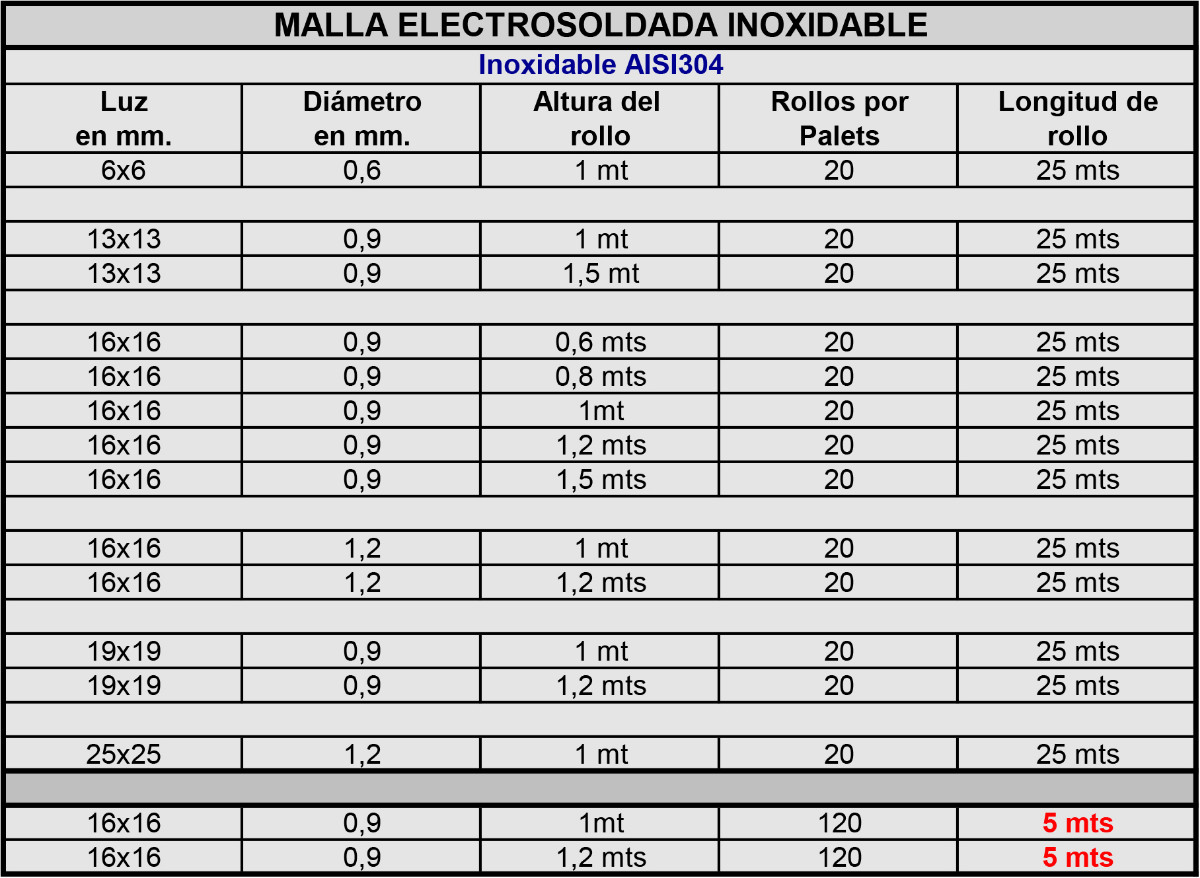

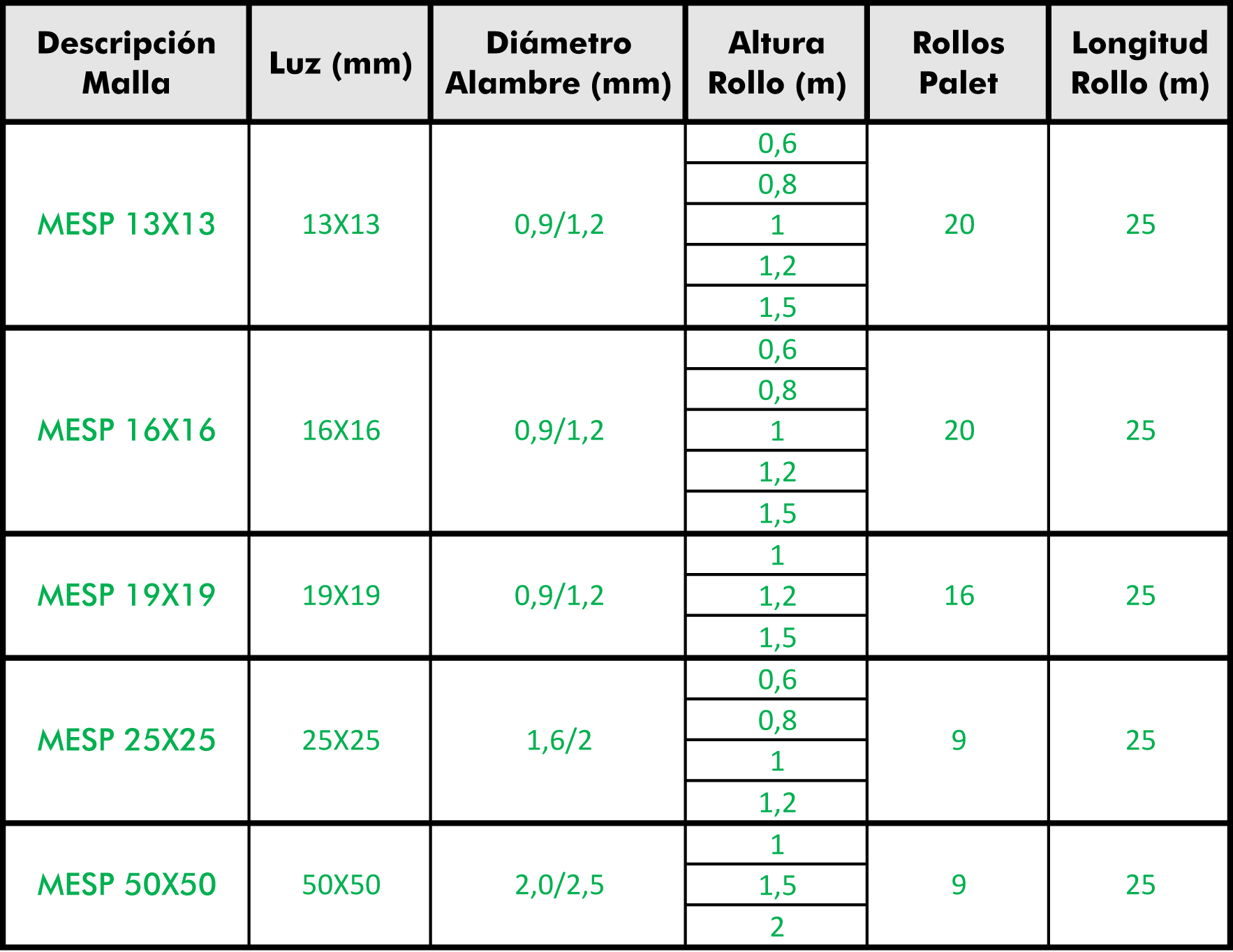

MALLA ELECTROSOLDADA MULTIMALLA GALVANIZADA SOLDADA - GruDisA Metal Desplegado Perforado Louvers Tableros y Mallas

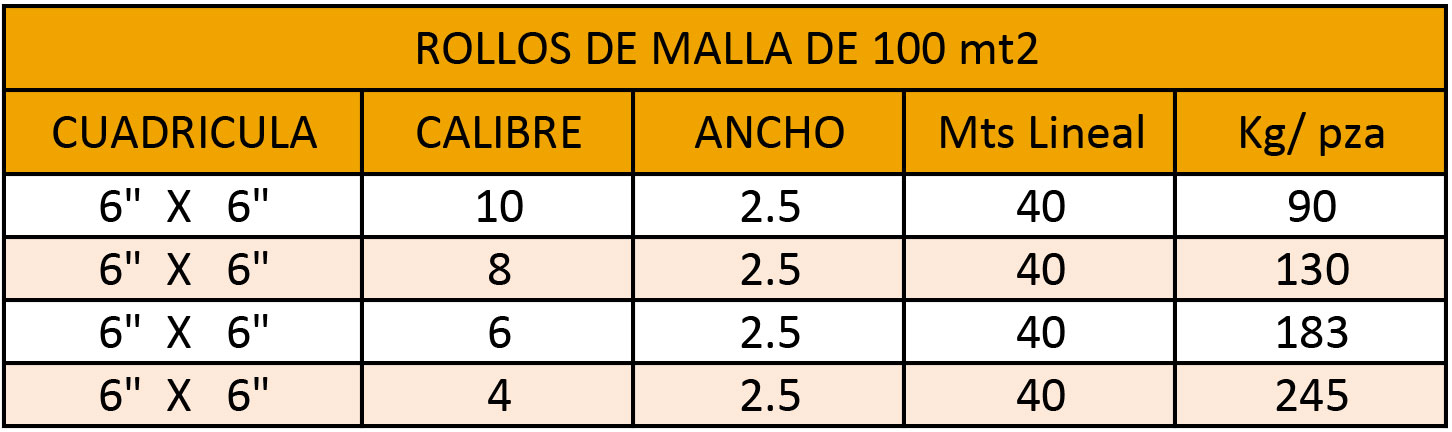

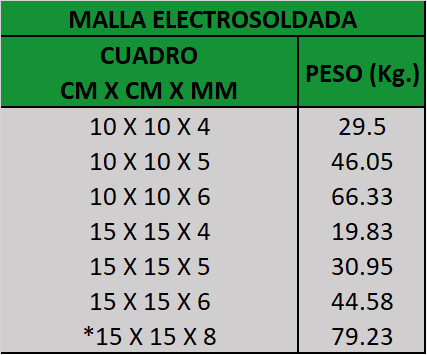

MALLA ELECTROSOLDADA MULTIMALLA GALVANIZADA SOLDADA - GruDisA Metal Desplegado Perforado Louvers Tableros y Mallas

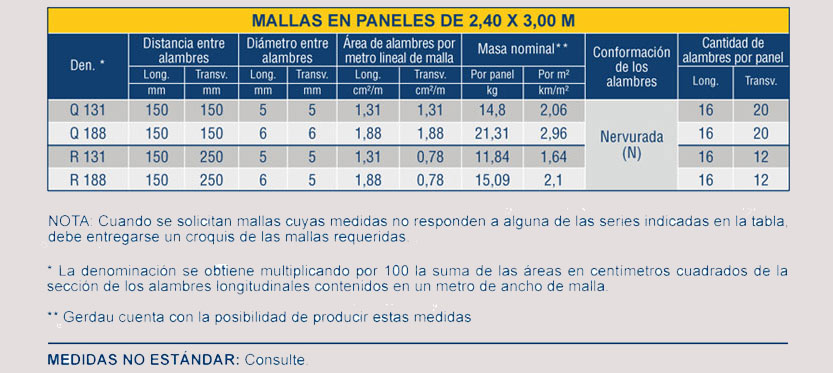

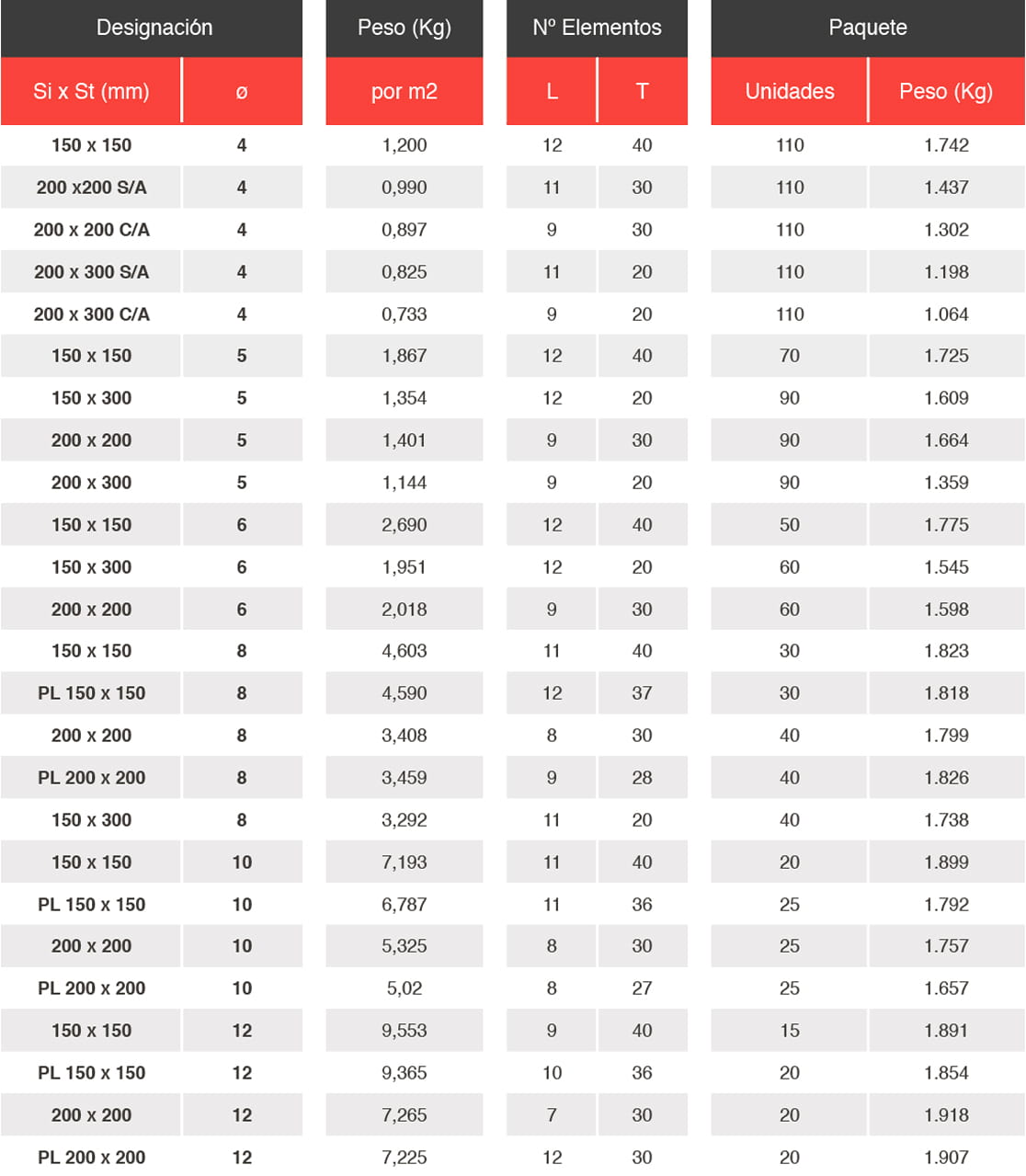

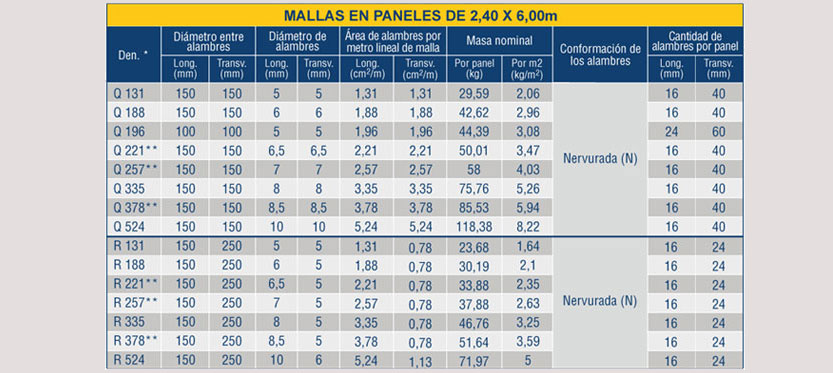

Mallas electrosoldadas | Gerdau - Guía de la Construcción / INSPIRATE Y PROYECTÁ. DESDE EL DISEÑO HASTA LA CONSTRUCCIÓN