Only Malaysians are so stupid as being forced to save and let their money goes missing without knowing how it will affect them in the future. How can anyone help this poor Malaysians from keeping fully promise on EPF?

The Employees Provident Fund (EPF) helps you save money for retirement. While you can’t withdraw your fund, EPF lets you invest some portion of your money in Unit Trust. However, we can’t rely too much since promise for higher return may comes with risk.

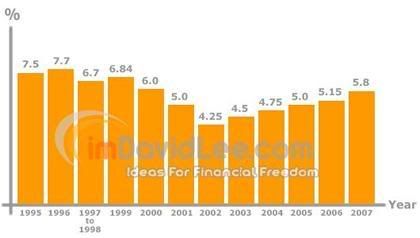

Generally speaking,current EPF return is 5.8%. EPF highest dividend payout is 8.5%, which was in between 1983-1987. After that, it drop to 8.0% (1988-1994).

Next article will be “How to invest in Unit Trust through EPF”. Stay Tuned…

Government should earn more than what we have expected..they just pay out divident so less..this is a good alternatives for us to decide..

you share good comparison here!

Hello David,

Nice to know another Malaysian blogger out there! I’ve added your link to my site to grow the Malaysian blogger community! Feel free to drop by site and give me some comments! Cheers 🙂

government more encourage us go for retirement fund cos it is about 70%

Not many unit trusts pay more than 10% too. If unlucky, you may get -ve. 🙂

I don’t mean to be too in your face, but I’m not sure I agree with this. Anyhow, thanks for sharing and I think I’ll come to this blog more often.

Pingback: Lower EPF Contribution, Good or Bad? | Reduction of Employee Contribution | Malaysia's Financial Blogger | imDavidLee.Com

Please keep these excellent posts coming.

When EPF for employee drops, accept it ASAP… why worry bout retirement fund? only lazy and unoptimistic people would depending on their EPF come 55… Take the extra of dropped % and start a fixed ASB deposit (Bumiputra) and dump in there… the interest given by ASB is much-much better than that so called EPF dividen…..

Hi David,

I would appreciate if you could share the origin of EPF past dividen payout data as KWSP website only furnish data from 2005 onwards. I need the data for some research purpose.

TQ

You got to admit, there is no fast solution.