Since July 2010, our Base Lending Rate (BLR) has increased 6.05% to 6.30%. As a result, borrowers have to pay additional months of installments. This is because when BLR increase, your interest payable or your loan tenure will also be increased subsequently.

For example:

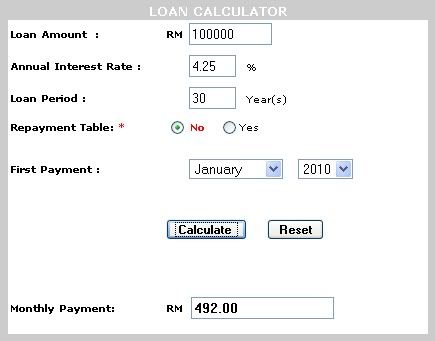

Total loan amount = RM 100,000 to be repaid over 30 years.

Previous interest amount = 6.05%

Monthly repayment = RM 492 (assuming a 4.25% after BLR – 1.8%)

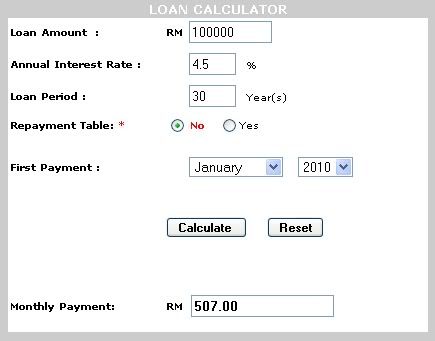

Current interest amount = 6.05% + 0.25%

Monthly repayment = RM 507

Difference in monthly repayment = RM15

So, you pay an extra 3% of your monthly installment over 30 years. Over 30 years, that’s about RM5,400 extra compared to what you’d to pay back originally. However, nobody can escape from the effect of BLR increased, unless you are buying your properties without any loans. We should think in another way round as your property value would appreciate more than that over the 30 years.

Even no borrowing, high BLR means higher opportunity cost for your investment!

Barring unforeseen circumstances, more views concur that BLR (or rather the OPR) will be adjusted upward again next year. Borrower suffer more; bank make more.

It is never good when you have that BIG uncertainty like the BLR that can threaten your loan payment.

Try having fixed rate loan instead. Last time I checked ING is offering the lowest fixed rate at 4.88% (if not mistaken) interest rates throughout loan tenure. No headaches trying to keep up with BLRs etc..

For me, BLR increased is just a minor effect to our investment. We should try to look on other factors as well.