I received a call from a banker last week, offering me a low interest personal loan of RM RM27,000 at 4.88% per year, with 3 or 5 years repayment terms. The idea put forth to me was that I could use this RM 27,000 to do some investment which probably can generate more than 8% return. Do you think it is a good idea to take up the loan?

However, I found that I would need to pay much higher interest as it’s based on a flat interest rate. For the flat interest rate calculation, you will be charged on the original principal amount, no matter how much you have paid off. So, it’s totally not same with our home loan interest in which it’s calculated based on monthly reducing balance, and you’ll be charged only on the outstanding amount.

Consequently, the effective interest rate (EIR) is higher than the normal flat rate. As a result, a 4.88% personal loan would roughly equal to a monthly reducing balance interest rate of 9-10%. So, be aware of the personal loan attractive offer next time!

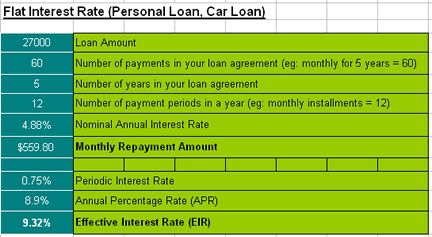

I have done a simple calculation to illustrate the total interest that I would have to pay on this RM 27,000 based on flat rate loan of 4.88%. See below:

Principal: RM 27,000

Interest rate: 4.88%

Tenure: 5 years

Monthly repayment: RM 559.80

Effective annual interest rate: 9.32%

If you want to make your life easier, then you can download my personal flat rate loan repayment calculator to help you in loan calculation.

In conclusion, don’t get too excited when a banker offers you a personal loan with the lower interest rate. But, you should do your math first then only consider whether to accept it or not.

Care to share which bank in Malaysia offering personal loan at 4.88% per year? Applies to non-bumi and working at private sector?