It is an opportunity for the Investor to participate in the oil palm in Malaysia since Malaysia produces the best oil palm so far, and oil palm is a consumable product to the world population because it’s not expensive and it’s naturally very safe to use.

Through this kind of investment:

– 1 plot is equivalent to RM 5,500. The minimum investment is 1 plot (1/4 acre).

– The projected annual return is range from 11% to 15% on the 4th year onwards. However, during the first 3 years, investors will be getting a fixed annual return of 8% per year.

– After the 23rd years of tenure period, investors might only obtain capital appreciation if there have buyback from Management Company or other buyer with a good price.

– Investor will not own the land because they are actually owning the trust. However, it is held by the Trustee. Investors basically are tight for 23 years period unless another person willing to take up the trust or buying from them.

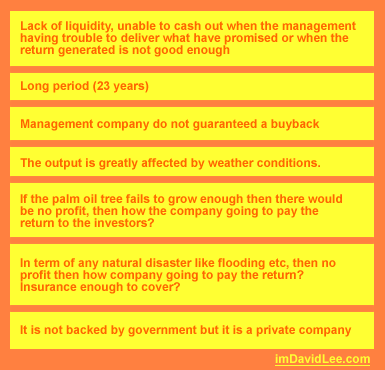

From my understanding and analysis, there may have some risk:

from 4th year onwards ..there will hav 0.1% charge

great analysis but i thnink it is in Gua Musang, Kelantan only right?

My parents used to have oil palm plantation but for certain reason, they do not make a great return from it.

interesting 🙂

will check back soon!

Cheers

it’s a risk an investor needs to think twice if they want to get the 8% returns per annum. moreover it’s hard to judge on this investment since there’s no track records. this company is only sort of regulated by a company act and i don’t even know about it.

now 1 plot become RM8000

I must say, that I could not agree with you in 100%, but it’s just my IMHO, which indeed could be wrong.

p.s. You have a very good template . Where did you find it?

I just happen to stumble on this site where comments seem to be from those not fully knowledgeable of the palm oil industry. I have had well over 40 years experience and therefore this is not the place to explain fully why I consider this as not a good but instead a terribly risky adventure.

Let me say this for now that there is another company that will soon launch a similar scheme and I hope that investors will not be fooled again.

Secondly and very briefly at RM8000 per quarter acre is sequivalent to about RM78000 per hectare – this in itself is terribly expensive for unplanted land which will take over seven years to become fully mature,

Thirdly since the entire acreage will only be planted say over a four year period then the total yield that will be available to be shared by all the investors will only materialise in say year 10 – repeat year 10.

The promoters are ripping off the investor by showing the 8% p.a. for the first three years (which is actually priced-in the RM8000.

The trustee scheme is only good for the initial years – it will eventually be mismanaged and the whole scheme will be in shambles – whilst the promoter has already collected a ridiculous price from the innocent “investor” .

Those who invested in Bungalow Land scheme from the same group CHHB in College Heights – practicaly 95% are now left in the lurch unable to sell their plots even at half the price they paid 15 years ago.

WATCH OUT ALSO FOR THE NEXT SIMILAR RIP-OFF SCHEME THAT WILL COME ON LINE SOON.

I am sad that there are so many gullible people out there who have now fully taken up all the lots put up – most of them might be senior citizens who have been coaxed into by the “higher than bank returns” by the well trained salesman who actually know nothing about the plantation business.

Let me tell you a little more;

1. The land is actually leasehold – investors have right to any title of the land.

2. At the end of the 23 year term the investor gets a share of the sale value of the land – now come, come open your brain and think whether anyone out there will pay RM78000 per hectare for oil palm trees that are due to be replanted? Dont forget also that the remaining term of the lease is also reduced by half to 33 years. So at best my guess is that the land would be worth RM5000 per acre – which means that at the end of the period the investor would be lucky to get back RM1250 per quarter acre lot for which he paid RM8000 now.

3. The Gua Musang area is about

the last place in Peninsular where new land is available for cultivation of oil palm/rubber. The reason this is the last area is because of the difficult terrain which together with potential threat from wild animals affects yields. If one looks at the MPOB statistics Kelantan has the lowest yield per hectare – the average yield per hectare in 2008 is 14.85 tons a range that has persisted for several years. The yields shown in the “Growers Scheme” are therefore not attainable.

4. When the yields fall far below the anticipated levels it will shock the Management who will then learn the reasons which are currently visible from the MPOB statistics. With such low yields optimising in year nine or ten there will be not enough profit to pay the promised rate of return.

5. Simple example is that if CPO prices range RM1901 -2000pmt the Management Company will have to pay 10% return – so on 40000 lots x RM8000 = RM320 mln. they will have to pay RM32mln from the 4th year onwards (reasonable to assume CPO prices remain this range). My own calculations show that even when yields optimise say year 10, they will still be in deficit of more than RM15 – 20mln in order to meet the RM32mln payout.

Dont’you think that they will be gone long before that with the RM320mln they have collected.

6. As I said earlier RM8000 for quarter acre (RM78000 per hectare) is ridiculous – preposterous for low yielding unplanted land in Gua Musang but yet the most heinous twist is to promise a rate of 10% (subject price range)when no such profits are attainable.

7. Do you all know that Lee Kim Yew is no more with Country Heights – sorry folks.

8 REPEAT WATCH OUT THERE IS ANOTHER COMPANY THAT IS PREPARING TO LAUNCH A SIMILAR SCHEME – PLEASE SPREAD THE WORD – CONTACT ME IF YOU NEED MORE ADVICE. MY EMAIL IS menon_prc@hotmail.com

What about Golden Palm Growers Scheme?

I’ve been trying to locate the company on the internet and it doesn’t seem to be there anymore.

Does anyone know if CHGS company is still alive and are we fooled of our money?

Dear all,

Hope everything is fine at your end.

First of all, we would like to introduce ourselves to you in regards of the Country Heights Grower Scheme matters, we are the publicist for the scheme.

We would be delighted to be the contact point to answer all your queries Country Heights Grower Scheme issues in future.

Please do not hesitate to contact us regarding the scheme and any other matters.

Thank you for your attention and have a nice day!