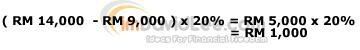

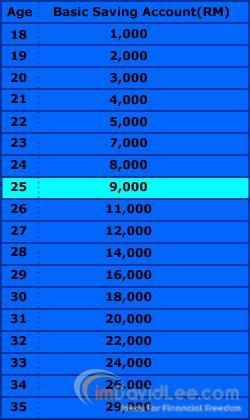

Under new “Beyond Savings” scheme, you can now make withdrawals from EPF Account 1 for investment. You are allowed to invest 20% of the amount in excess of the required basic savings in Account 1 and minimum investment for unit trust is RM1,000. For example, the basic savings amount for a contributor who aged 25 (like me) is RM9,000. So, in order to withdraw for UT investment, I must have RM14,000. Do you know why?

Calculation:

Thus, different age may have different basic savings amount.

How much would one need for retirement?

Experts say this depends on the individual and his lifestyle. And how much he is willing to reduce consumption such as eat out less often, buy fewer things, live in a smaller house, drive less, and travel less. In fact, financing database Motley Fool have figures which show that even as little as 2% cut on monthly expenses can boost retirement funds by as much as 500%.

More younger people are becoming bankrupt as they are spending “tomorrow’s money”. Which basically means these people are not saving or building their retirement nest.

this will mean that people who aged above 25 must need more than RM9k inside their basic saving?

for me i will need to wok for 2 more year then only can do such kind of invest

Good post on withdrawing EPF for investment. I don’t aware it is based on the age.