Now I only realize that there’ll have 50% stamp duty exemption on transfer for the purchasing house which costing not more than RM250,000. This stamp duty will be charged on any loan agreement that is executed between buyer and bank. However, it’s only applicable not later than 31st December 2010.

If you are the first time home buyer and plan to buy a house at price RM260k. Then, it’s advisable to make it below RM250k to eligible for the 50% stamp duty exemption. Previously, if let say your house cost RM250k, then stamp duty will be RM4k which calculated as below:

1st RM100k = RM100k x 1%

= RM1k

Next RM150k = RM150k x 2%

= RM3k

50% discount on stamp duty = RM4k x 50%

= RM2k only

However, if you are planning to buy a low-cost house, then you will get full stamp duty exemption on all documents, including loan agreements. You need to be a Malaysian citizen to be eligible for the exemption and it is limited to the 1st application only and it’s effective for sale and purchase agreements executed from 30th Aug 2008 – 31st Dec 2010.

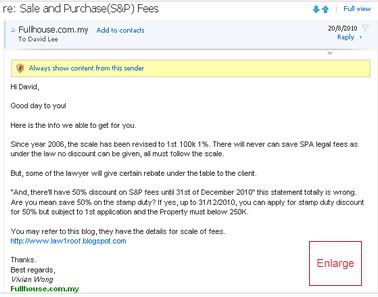

I obtained these information through email replied from Fullhouse.com.my. Below is the email replied,

What a post!! Very informative and easy to understand. Looking for more such posts!! Do you have a facebook?

I recommended it on stumbleupon. The only thing that it’s missing is a bit of new design. Nevertheless thank you for this blog.

Buy for investment (if already own 2 properties) can get exemption?

If yes, must start looking for some reasons:-

– Before the 80% max loan rule comes

– Before property price moving up further

– Save $ on the 50% waiver.

Hi stumbled across your site. Good job!

Btw I think its 350k instead of 250k .. and I think its AFTER 31Dec2010 meaning snp come into effect during year 2011 only you are eligible for either 100% loan or rebates to MOT + LA ..

Hi,

I have spotted a townhouse which cost RM210000

I have no idea what do I need to do or pay.. Anyone is kind enough to tell me that??? Thanks!!

Ask your agent?

Generally, you need to pay 3% upon booking and balance 7% upon signing sale & purchase agreement within 14 days after booking.

Then, looking for loan immediately after paying the 3%.

I’m not a agent.. Planning to buy my first house?? Roughly how much the legal fee will cost??

Cassandra,

You need to consider also bank loan contract charges besides the S&P agreement.

Just google around on “How To Buy A House”, i think you can get good info online. 😛

if let said you have 1/3 of the inherit property from your parent, do you still qualify to entitle the 50% discount on both the bank loan and s & p stamp duty, that is the first purchase house.